What Is Zakat in Islam sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Zakat, a fundamental pillar of Islam, is more than just a religious obligation; it’s a system for wealth redistribution, fostering social justice and economic stability within Muslim communities.

This guide will explore the multifaceted aspects of Zakat, from its definition and core principles to its practical application in contemporary society.

This comprehensive guide delves into the intricacies of Zakat, examining its various types, eligibility criteria, calculation methods, and recipients. We’ll also explore the historical context, social benefits, and modern challenges of implementing Zakat, ultimately offering a thorough understanding of this crucial Islamic practice.

Defining Zakat

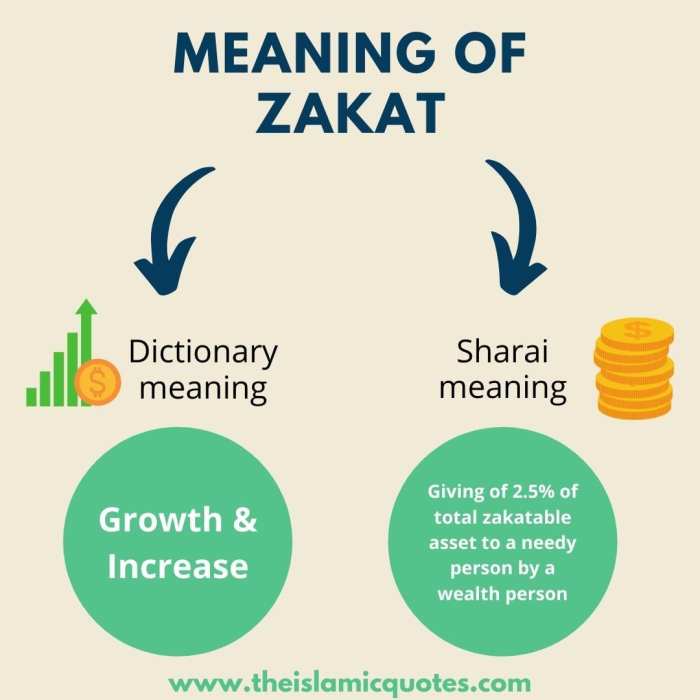

Zakat, a cornerstone of Islam, is more than just a tax; it’s a vital act of worship and social responsibility. It’s a compulsory form of charity designed to purify wealth and redistribute it amongst the needy. Understanding Zakat involves recognizing its profound spiritual and societal implications.Zakat is fundamentally about purification, both of one’s wealth and one’s heart. By giving a portion of one’s wealth to those in need, Muslims demonstrate gratitude for blessings received and actively participate in building a more just and equitable society.

This act fosters compassion and strengthens the bonds within the Muslim community.

Zakat, a core Islamic principle, is essentially a form of obligatory charity. It’s a way to purify wealth and ensure those less fortunate can also participate in the blessings of life. Interestingly, while reflecting on the spiritual aspects of Zakat, I stumbled upon news about David Byrne’s Luaka Bop’s 25th-anniversary events and William Onyeabor’s discography box set , a fascinating musical journey.

Thinking about the shared values of giving back and appreciation in both these areas reminds me of the importance of Zakat’s role in Islamic society.

Zakat: A Concise Definition

Zakat, in its essence, is a prescribed form of charity in Islam. It’s an obligatory payment, calculated on specific assets, payable to designated recipients. This payment aims to cleanse the wealth of the giver and provide sustenance for the less fortunate.

Core Principles of Zakat

The core principles of Zakat underpin its significance and application. It emphasizes the importance of wealth redistribution, the concept of shared responsibility, and the inherent obligation to support those in need. These principles highlight the social and ethical dimension of Islam.

Types of Zakat

Islam Artikels different types of Zakat, each relating to specific categories of wealth. Understanding these types is crucial for accurate calculation and application. The types include Zakat on wealth, Zakat on agricultural produce, Zakat on livestock, and Zakat on trade profits.

Zakat on Wealth (Mal)

This type of Zakat applies to certain types of wealth accumulated over a specific period. It’s calculated based on the value of the assets, such as gold, silver, and other precious metals, and it’s a significant part of the Islamic financial system.

Zakat, a core principle in Islam, is essentially a form of charity. It’s about giving a portion of your wealth to those in need, a vital practice for maintaining economic fairness and social harmony. This often involves a complex calculation, but in a world with so many charitable causes, I’ve been particularly intrigued by the latest collaboration between Listen to Airs and Beach Houses Victoria Legrand Seven Stars, listen to airs collaboration with beach houses victoria legrand seven stars , which highlights the importance of supporting the arts while simultaneously giving back to the community.

Ultimately, Zakat is a powerful reminder that we should always look for ways to share our blessings and uplift others.

Zakat on Agricultural Produce (Zakat al-Fitt)

Zakat on agricultural produce, often referred to as Zakat al-Fitt, is calculated on crops that have reached a specific level of maturity and abundance. The rate of Zakat varies depending on the type of crop and the harvest conditions.

Zakat on Livestock

Zakat on livestock is calculated based on the number and type of livestock owned. Different rates apply to cattle, sheep, and camels, reflecting the varying values and needs.

Zakat on Trade Profits (Zakat al-Tijarah)

Zakat on trade profits is calculated on the net profits gained from business transactions. It’s assessed based on the amount of profit earned during a specific period.

Comparison of Zakat Types

| Type of Zakat | Applicable Assets | Conditions for Payment | Recipients |

|---|---|---|---|

| Zakat on Wealth (Mal) | Gold, silver, cash, and other assets | Nisaab (minimum threshold) is met, and the asset is owned for a full lunar year. | Specific categories of recipients Artikeld in Islamic jurisprudence. |

| Zakat on Agricultural Produce (Zakat al-Fitt) | Specific agricultural produce (e.g., dates, wheat, barley) | The produce has reached a certain level of maturity and abundance. | Specific categories of recipients Artikeld in Islamic jurisprudence. |

| Zakat on Livestock | Cattle, sheep, and camels | The livestock reaches a certain number. | Specific categories of recipients Artikeld in Islamic jurisprudence. |

| Zakat on Trade Profits (Zakat al-Tijarah) | Net profits from business transactions | The profit reaches the Nisaab threshold. | Specific categories of recipients Artikeld in Islamic jurisprudence. |

Obligations and Requirements

Zakat, a cornerstone of Islam, isn’t just about giving; it’s about fulfilling a spiritual obligation and ensuring equitable distribution of wealth within the community. Understanding the requirements and conditions surrounding Zakat is crucial for its proper and meaningful implementation. This section delves into the eligibility criteria, calculation specifics, and the critical role of intention in fulfilling this important Islamic duty.The process of Zakat isn’t arbitrary; it’s governed by specific rules designed to maximize its impact and ensure fairness.

It’s essential to understand these rules, not just to fulfill the obligation, but to appreciate the profound social and economic implications of this act of charity.

Eligibility Criteria for Paying Zakat

Individuals must meet specific criteria to be eligible to pay Zakat. The most fundamental criteria is the possession of a certain amount of wealth, known as Nisab, beyond the basic needs. This threshold varies based on the type of asset and the prevailing economic conditions. Further, the wealth must have been in possession for a complete lunar year (Hawl).

This ensures that Zakat is not levied on temporary or fluctuating wealth.

Conditions for Calculating Zakat on Different Assets

The calculation of Zakat differs based on the type of asset. Different asset classes have varying Zakat rates and methodologies. For example, Zakat on gold and silver is calculated based on their weight and value, whereas Zakat on agricultural produce depends on the harvest’s yield and quality.

Importance of Intention (Niyyah) in Zakat

The intention (Niyyah) behind paying Zakat is crucial. Zakat is not merely a transaction; it’s an act of worship. The sincerity of intention plays a significant role in its spiritual merit. A heartfelt intention to fulfill the obligation of Zakat, coupled with the desire to benefit others, elevates the act beyond a simple financial transaction. A person giving Zakat with a pure intention is more likely to experience the spiritual and communal rewards associated with it.

Minimum Amount (Nisab) Required for Zakat Obligation, What Is Zakat in Islam

The Nisab is the minimum amount of wealth required to trigger the obligation of Zakat. This threshold is calculated based on the prevailing market value of gold and silver. The exact value varies over time due to fluctuations in market prices. Current values for Nisab for gold and silver are regularly updated and publicly available. For example, if the Nisab for gold is 85 grams, any individual possessing gold valued above this amount in excess of their personal needs would be obligated to pay Zakat.

Different Types of Assets Subject to Zakat and Calculation Methods

| Asset Type | Nisab (Approximate Value in USD, 2024) | Zakat Rate | Calculation Method |

|---|---|---|---|

| Gold | $2,000 | 2.5% | Weight x Current Gold Price x 2.5% |

| Silver | $60 | 2.5% | Weight x Current Silver Price x 2.5% |

| Agricultural Produce | Specific to the produce | 5% or 10% | Yield x Rate based on produce type (5% for dates, 10% for other crops) |

| Business Inventory | Specific to the type of inventory | 2.5% | Market Value of Inventory x 2.5% |

| Cash | $2,000 | 2.5% | Total Cash x 2.5% |

This table provides a general overview. Specific conditions and calculations may vary based on local customs and interpretations.

Purpose and Benefits: What Is Zakat In Islam

Zakat, a cornerstone of Islam, transcends mere financial obligation. It is a profound system designed to foster social justice, economic stability, and spiritual growth within the Muslim community. Beyond its material implications, Zakat embodies a commitment to shared prosperity and a compassionate response to the needs of those less fortunate.Zakat isn’t simply about giving away wealth; it’s a structured approach to wealth redistribution that aims to create a more equitable society.

This redistribution helps to alleviate poverty, reduce inequality, and promote a sense of collective responsibility among Muslims. It is an integral part of the Islamic faith, emphasizing not only material support but also the spiritual benefits of generosity and compassion.

Social and Economic Objectives

Zakat plays a crucial role in achieving social and economic equilibrium within Muslim communities. Its primary objectives include poverty alleviation, economic empowerment, and the promotion of social harmony. It aims to reduce wealth disparity and create a more just society where everyone has access to basic necessities. The system’s effectiveness stems from its structured approach to wealth redistribution.

Examples of Fostering Social Justice and Economic Stability

A prime example of Zakat’s impact on social justice is the support it provides to the poor and needy. Families facing hardship, individuals struggling to meet basic needs, and communities affected by natural disasters often receive crucial aid through Zakat funds. These funds can provide food, shelter, and medical care, allowing vulnerable individuals to regain their footing and participate more fully in society.

Additionally, Zakat funds often support small businesses and entrepreneurs, stimulating economic growth and creating employment opportunities.

Benefits to Individuals and Society

Zakat offers substantial benefits to both individuals and society. For individuals, it promotes a sense of compassion, generosity, and spiritual purification. By giving back to the community, individuals strengthen their connection to Allah and build a more just and compassionate society. For society, Zakat fosters social cohesion, reduces poverty, and promotes economic stability. It creates a safety net for the vulnerable and encourages a culture of shared responsibility.

Alleviating Poverty and Reducing Inequality

Zakat’s primary function is to alleviate poverty and reduce inequality. By channeling wealth towards those in need, Zakat creates a safety net for vulnerable members of the community. This can include the elderly, orphans, widows, and individuals facing economic hardship. Zakat funds can provide crucial support for education, healthcare, and other necessities, ultimately empowering individuals to escape cycles of poverty and build a better future.

Support for Charitable Causes

Zakat funds are used to support a wide range of charitable causes, addressing diverse needs within the community.

Zakat, a cornerstone of Islam, is essentially a form of obligatory charity. It’s about sharing your blessings with those less fortunate, a way to purify wealth and gain spiritual rewards. Meanwhile, a fun fact about the upcoming Jumanji reboot has a director releases this Christmas, here’s the scoop. This act of giving, like the joy a new movie brings, strengthens the community and fosters a more equitable society, which is central to the principles of Zakat.

| Category | Description |

|---|---|

| Basic Needs | Food, shelter, clothing, and medical care for the poor and needy. |

| Education | Scholarships, educational programs, and support for schools and educational institutions. |

| Economic Empowerment | Small business loans, vocational training, and support for entrepreneurs. |

| Healthcare | Medical care, hospitals, and clinics serving the underprivileged. |

| Disaster Relief | Support for communities affected by natural disasters, providing immediate aid and long-term recovery assistance. |

Zakat is not just a financial transaction; it is a fundamental aspect of Islam that promotes social justice, economic stability, and spiritual growth.

Zakat Calculation Methods

Zakat, a cornerstone of Islam, is calculated based on specific criteria for various assets. Understanding these calculations ensures the proper fulfillment of this religious obligation. Accurate calculation is crucial to ensure the intended recipients receive the rightful portion of the zakat.

Calculating Zakat on Gold and Silver

Determining Zakat on gold and silver involves a specific calculation based on the value of the metal and a pre-defined Nisab (threshold). The Nisab for gold is 85 grams, and for silver, it is 595 grams. If the value of the gold or silver held exceeds the Nisab, Zakat is payable.

- Calculate the value of your gold or silver in the currency of your choice. This could be local currency or a globally recognized currency like US Dollars.

- Determine if the value exceeds the Nisab. If it does, proceed to the next step; otherwise, no Zakat is due.

- Calculate 2.5% of the value exceeding the Nisab. This is the amount of Zakat payable.

Calculating Zakat on Livestock

Zakat on livestock is calculated based on the number of animals and their type. Different rates apply for different types of livestock, and the specific Nisab values also vary.

- Determine the type and number of livestock (e.g., cows, sheep, camels).

- Identify the Nisab for the specific livestock type. For example, the Nisab for camels varies based on their number. Refer to a reliable source for the specific Nisab amounts.

- Calculate the Zakat based on the rates defined for the type of livestock. The rate is often a fixed percentage for each animal category beyond the Nisab.

Calculating Zakat on Agricultural Produce

Zakat on agricultural produce is calculated based on the yield of the harvest. The rate is dependent on the type of produce and the amount harvested.

- Determine the type of agricultural produce (e.g., dates, wheat, rice).

- Establish the Nisab amount for the specific produce. This threshold varies depending on the produce. For instance, the Nisab for dates and other similar produce is based on the amount of produce that is equal to a particular volume or weight.

- Calculate the amount harvested.

- Calculate the Zakat based on the rates applicable to the specific produce. This often involves calculating 10% of the yield above the Nisab.

Calculating Zakat on Trade Goods

Zakat on trade goods is calculated based on the value of the goods and the period of ownership. The method considers the value of the goods.

- Assess the total value of the trade goods. This includes the total value of all goods held for trade.

- Determine the period of ownership. This is usually the period from when the goods were acquired until they were sold or otherwise disposed of. The calculation is made on the current value of the goods.

- Calculate the Zakat by applying a 2.5% rate to the net value of the goods after deducting any outstanding debts or liabilities. This calculation is based on the value of the trade goods held for the period of a lunar year.

Calculating Zakat on Savings Accounts

Zakat on savings accounts is calculated similarly to zakat on gold and silver. The value of the savings is the basis for the calculation.

- Determine the value of your savings in the savings account. This amount is used to determine if the amount exceeds the Nisab for zakat calculation.

- Determine if the savings exceed the Nisab. If it does, proceed to the next step. Otherwise, no Zakat is due.

- Calculate 2.5% of the value exceeding the Nisab. This is the amount of Zakat payable.

Zakat Calculation Formulas

| Zakat Type | Formula | Example |

|---|---|---|

| Gold/Silver | (Value of Gold/Silver – Nisab) – 0.025 | If Gold = 1000 grams, Nisab = 85 grams, Value = $10000. Zakat = ($10000 – $850) – 0.025 = $236.25 |

| Livestock | (Number of Animals – Nisab) – Rate | If Sheep = 120, Nisab = 40, Rate = 1/40. Zakat = (120 – 40) – (1/40) = 2 |

| Agricultural Produce | (Value of Produce – Nisab) – 0.10 | If Wheat = 1000 kg, Nisab = 653 kg, Value = $1000. Zakat = ($1000 – $653) – 0.10 = $34.70 |

| Trade Goods | (Value of Goods – Debts) – 0.025 | If Goods = $5000, Debts = $1000, Zakat = ($5000 – $1000) – 0.025 = $100 |

| Savings | (Savings Amount – Nisab) – 0.025 | If Savings = $10000, Nisab = $850, Zakat = ($10000 – $850) – 0.025 = $236.25 |

Zakat Recipients

Zakat, a cornerstone of Islam, is not just about financial obligation; it’s a profound act of social responsibility. A crucial aspect of Zakat is the equitable distribution of funds to those most in need. Understanding the specific categories of recipients and their unique circumstances is essential to ensuring the proper application of this vital Islamic practice.

Eight Categories of Zakat Recipients

Zakat is meticulously designed to reach those genuinely in need. The Quran specifies eight categories of individuals and groups eligible to receive Zakat. These categories reflect a comprehensive approach to addressing various societal vulnerabilities and ensuring a just and equitable distribution of wealth.

- The Poor (Al-Fuqara): These are individuals with extremely limited resources, lacking the basic necessities for survival. Their poverty is often chronic and deeply entrenched, requiring consistent support to escape their circumstances. Examples include families living below the poverty line, struggling with homelessness, and those facing severe food insecurity. Such individuals may have limited or no means of supporting themselves or their families.

- The Needy (Al-Masakin): While not as impoverished as the poor, the needy still experience significant hardship and lack sufficient resources to meet their basic needs. This category often encompasses those with fluctuating incomes, facing temporary setbacks or unforeseen circumstances, such as job loss, illness, or natural disasters. These situations often require immediate and timely assistance to mitigate suffering.

- Zakat Collectors (Al-Amilun): These are individuals appointed to collect and distribute Zakat. They are entrusted with a vital role, requiring significant responsibility and integrity. Their remuneration ensures they can perform their duties without personal hardship, focusing solely on the administration of Zakat.

- Those whose hearts are to be reconciled (Al-Muallafatu Quloobuhum): This category focuses on those recently converted to Islam. These individuals may face social ostracism or economic hardship due to their conversion. Zakat can provide financial support and social integration, helping them adjust to their new faith and community.

- Slaves (Ar-Riqab): The emancipation of slaves was a critical aspect of Zakat in early Islamic society. Zakat funds were utilized to purchase and free slaves who were in desperate need of liberation. This act demonstrates a commitment to human dignity and freedom.

- Those in Debt (Al-Gharimin): Individuals burdened by significant debt can face dire consequences. Zakat can provide vital support to relieve their financial strain and enable them to rebuild their lives. This assistance can include repayment of debts or securing loans to help them emerge from their financial challenges.

- Those engaged in Jihad (Al-Muqatilin): This category refers to those actively participating in the Islamic struggle, particularly those involved in self-defense or resisting oppression. Zakat funds can be used to support their efforts, equipping them with the necessary resources and providing them with financial aid to sustain their struggle. This category often involves those in active conflict situations or military service.

- The Travelers (Ibnus-Sabil): Individuals who are stranded or traveling and face hardship or financial difficulties during their journey. Zakat funds can provide them with the necessary provisions and support to reach their destination safely and securely. These individuals may be facing unforeseen circumstances or delays, requiring immediate assistance to navigate their travel challenges.

Importance of Fairness and Transparency

Fairness and transparency are paramount in Zakat distribution. The system must ensure that the funds reach the intended recipients without bias or corruption. This necessitates meticulous record-keeping, clear criteria for eligibility, and impartial evaluation processes.

Examples of Zakat Use

Zakat funds can be used in various ways to benefit the recipients. For example, the funds can be directly distributed as cash assistance, used to provide essential food supplies, support educational programs, or create employment opportunities. There are numerous examples where Zakat funds have been used to alleviate poverty, improve living conditions, and empower individuals. These examples highlight the tangible positive impact Zakat can have on the lives of the needy.

Summary Table

| Category | Needs |

|---|---|

| Poor (Al-Fuqara) | Basic necessities, chronic poverty |

| Needy (Al-Masakin) | Temporary hardship, insufficient resources |

| Zakat Collectors (Al-Amilun) | Compensation for services |

| Those whose hearts are to be reconciled (Al-Muallafatu Quloobuhum) | Financial support, social integration |

| Slaves (Ar-Riqab) | Freedom, emancipation |

| Those in Debt (Al-Gharimin) | Debt relief, financial recovery |

| Those engaged in Jihad (Al-Muqatilin) | Support for struggle, resources |

| The Travelers (Ibnus-Sabil) | Assistance during travel |

Contemporary Issues and Practices

Navigating the complexities of modern life presents unique challenges in implementing Zakat, a fundamental pillar of Islam. The traditional methods of Zakat collection and distribution, often reliant on community trust and established social structures, face adaptation to contemporary financial landscapes. Furthermore, the rise of digital transactions and globalized economies requires innovative approaches to ensure Zakat effectively addresses the needs of the poor and vulnerable in the 21st century.Traditional Zakat systems, while effective in many contexts, sometimes struggle to keep pace with the rapid evolution of modern economies.

Challenges arise from the increased complexity of financial instruments, the rise of informal economies, and the challenges of accurately identifying and verifying the assets of potential Zakat payers. The adaptability of Zakat systems to these evolving economic realities is crucial for its continued relevance and effectiveness.

Challenges in Implementing Zakat in Modern Societies

Implementing Zakat in modern societies presents several obstacles. These include the increasing prevalence of informal economies and digital transactions, which can make asset valuation and identification difficult. The complexities of modern financial instruments, such as investment accounts and cryptocurrency holdings, also pose challenges for Zakat calculation. Ensuring transparency and accountability in Zakat administration is crucial in addressing these challenges and maintaining public trust.

Examples of Zakat Systems Adapting to Contemporary Financial Situations

Several Zakat institutions are adapting to contemporary financial situations. Some are developing sophisticated methodologies for calculating Zakat on complex financial instruments, such as stocks and mutual funds. Others are utilizing technology to track and verify assets, particularly in informal economies, where traditional methods may be less effective. This adaptability is vital to ensuring Zakat remains a relevant and practical system for the modern era.

For example, some Islamic banks are integrating Zakat calculations directly into their financial products and services.

Role of Technology in Modern Zakat Collection and Distribution

Technology plays an increasingly significant role in modern Zakat collection and distribution. Online platforms are being used to streamline the process of Zakat calculation and payment, providing greater accessibility and transparency. Mobile applications can connect Zakat payers with beneficiaries, facilitating direct transfers and improving efficiency. Furthermore, data analytics can be used to identify vulnerable populations and target Zakat funds more effectively.

Examples of Successful Zakat Initiatives in Different Parts of the World

Several successful Zakat initiatives have demonstrated the effectiveness of adapting traditional practices to modern contexts. For instance, in some parts of Southeast Asia, innovative Zakat funds are being used to support microfinance initiatives, empowering local communities to start businesses and improve their economic conditions. Similarly, in some African countries, Zakat funds are being channeled to provide educational opportunities and healthcare services.

Comparison of Zakat Administration Models

Different regions and communities have adopted various models for Zakat administration. This table highlights key differences in these models, including the level of government involvement, the use of technology, and the focus on specific beneficiaries.

| Model | Government Involvement | Technology Usage | Focus on Beneficiaries |

|---|---|---|---|

| Centralized Model (e.g., Saudi Arabia) | High | Moderate | Broad-based poverty alleviation |

| Decentralized Model (e.g., some parts of Africa) | Low | Low | Community-based initiatives |

| Hybrid Model (e.g., some Southeast Asian countries) | Moderate | Increasing | Microfinance and entrepreneurship support |

Illustrative Examples

Zakat, a cornerstone of Islam, is not just a financial obligation but a powerful tool for social justice and economic empowerment. Understanding its practical application through real-world examples illuminates its multifaceted role in improving lives and fostering community well-being. This section delves into specific calculations, case studies, and regional implementations to showcase the tangible impact of Zakat.

Zakat Calculation Examples

Calculating Zakat involves determining the Nisab (the minimum amount of wealth) and then applying the 2.5% rate to the excess above this threshold. Different assets, such as gold, silver, livestock, and agricultural produce, have unique Zakat calculation methodologies.

Example 1: Gold

A Muslim owns 100 grams of gold. The current Nisab for gold is approximately 85 grams. The excess (100 grams – 85 grams = 15 grams) is subject to Zakat. The Zakat amount would be 15 grams

2.5% = 0.375 grams of gold.

Example 2: Agricultural Produce

A farmer has a harvest of 1000 kilograms of dates. The Nisab for dates is usually a specific amount. If the harvest exceeds the Nisab, then the Zakat amount is calculated as 2.5% of the excess over the Nisab. Assume the Nisab is 500 kilograms; Zakat would be calculated on the 500 kilograms (1000kg – 500kg = 500kg). Zakat due would be 500 kg

2.5% = 12.5 kilograms of dates.

Example 3: Livestock

The calculation for livestock, such as camels, cows, and sheep, depends on the number of animals and their specific types. For instance, the Zakat for camels is determined based on the number of camels owned and their classification, and the Nisab differs based on the type of livestock.

Case Studies of Zakat Impact

Numerous examples demonstrate the positive influence of Zakat on individual and community well-being. Many organizations support projects that utilize Zakat funds to provide educational opportunities, build infrastructure, and support families in need. These efforts often result in significant improvements in quality of life and economic opportunities.

Example 1: Community Development in Rural Pakistan

Zakat funds were used to construct a community center in a rural area in Pakistan. The center provided educational programs, skill-building workshops, and a marketplace, boosting local businesses and providing access to essential services. This led to a decrease in poverty and increased economic stability in the area.

Example 2: Supporting Orphanages in Bangladesh

Zakat funds contributed significantly to the support of orphanages in Bangladesh. This included providing food, shelter, clothing, and educational resources to children who otherwise might not have had access to these basic necessities.

Zakat Implementation in Different Muslim Countries

Zakat implementation varies across Muslim countries due to differing legal frameworks and cultural contexts. Some countries have dedicated Zakat authorities to manage and distribute funds effectively, while others rely on community-based initiatives or a combination of both approaches.

- Saudi Arabia: Saudi Arabia has a well-established Zakat administration. This includes regulations and procedures for the collection and distribution of Zakat funds.

- Indonesia: Indonesia, with its large Muslim population, has a more complex Zakat system. Local regulations and practices vary, with a combination of government involvement and community-led initiatives.

- Malaysia: Malaysia utilizes a mix of governmental and non-governmental organizations to administer Zakat, aiming to ensure transparency and effectiveness in its disbursement.

Impact of Zakat on Poverty Reduction

| Region | Zakat Impact (Estimated figures for illustrative purposes only) | Description |

|---|---|---|

| Rural Pakistan | Reduced poverty rate by 15% | Increased access to education and skills development. |

| Urban Bangladesh | Improved access to healthcare services | Enhanced support for vulnerable families through financial aid. |

| Sub-Saharan Africa | Increased access to clean water and sanitation. | Facilitated establishment of micro-businesses. |

Note: The figures in the table are illustrative and represent potential impacts, not exact data. Specific figures can vary depending on factors such as the methodology used for assessment.

Examples of Zakat Application

| Category | Example |

|---|---|

| Education | Funding scholarships for students, providing educational resources. |

| Healthcare | Supporting hospitals, clinics, and providing medical assistance to the needy. |

| Housing | Providing shelter and support for the homeless, building affordable housing units. |

| Economic Empowerment | Supporting micro-finance initiatives, skill-building workshops, and small business loans. |

Final Thoughts

In conclusion, Zakat is a multifaceted practice that transcends mere financial obligations. It’s a system designed to promote social justice, economic stability, and individual piety within the Muslim community. By understanding the principles and practicalities of Zakat, we gain a deeper appreciation for its profound impact on the lives of individuals and communities alike. This exploration provides a foundational understanding of Zakat, paving the way for further inquiry and engagement with this vital aspect of Islamic practice.