Activate Your ATM Card: Ready to unlock your new ATM card’s full potential? This comprehensive guide walks you through the entire process, from initial activation steps to troubleshooting any issues that may arise. We’ll cover everything you need to know, whether you’re getting a brand-new card, replacing a lost one, or just need a refresher on the activation procedure.

This guide will help you navigate the activation process easily and securely, ensuring you can confidently use your ATM card for all your financial transactions. We’ll explore different activation methods, security measures, and troubleshooting tips to help you avoid common pitfalls. Let’s get started!

Initial Steps for Activation

Activating your ATM card is a crucial step to ensure secure and convenient access to your funds. This process varies depending on the issuing bank and the method of activation chosen. Understanding the steps and potential issues can help you navigate the activation process smoothly.A well-defined activation procedure safeguards your financial information and prevents unauthorized access to your accounts.

Following the correct steps and providing accurate details are essential for a successful activation.

Activation Methods

Different banks offer various methods for activating your ATM card. These methods typically include online portals, mobile apps, and phone calls. Choosing the appropriate method depends on your preference and the available options provided by your bank.

- Online Portals: Many banks provide online portals where you can access and manage your accounts, including activating new or replacement cards. This method often requires logging in with your account credentials and following the specific instructions provided by the bank.

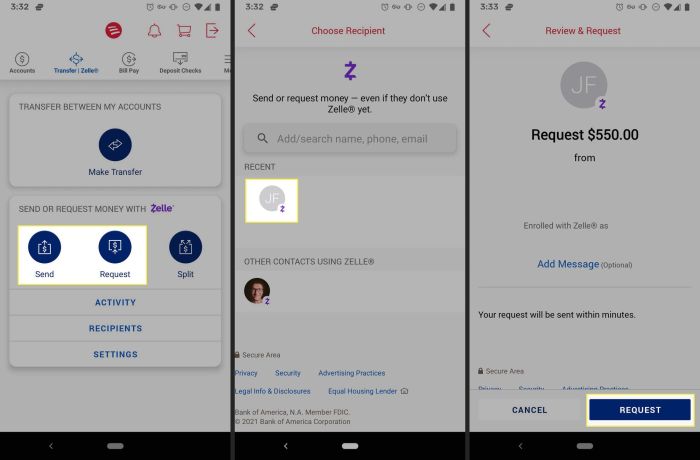

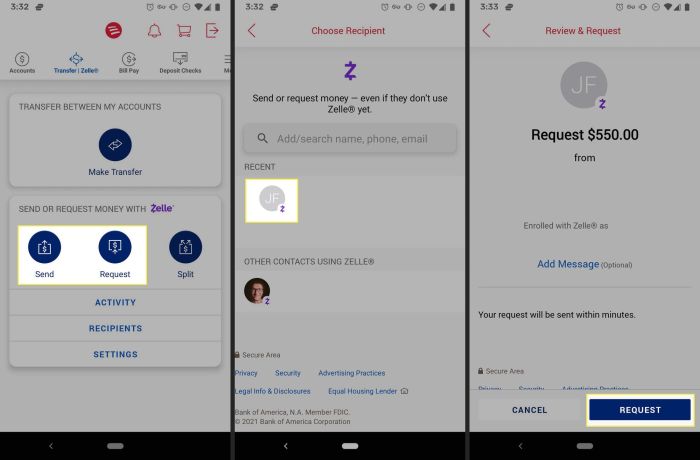

- Mobile Apps: Dedicated mobile apps allow users to manage their accounts and perform transactions from their smartphones. Activating an ATM card via the mobile app is a convenient option for many users, offering real-time updates and secure access.

- Phone Calls: Contacting your bank’s customer service line is another common method for activating an ATM card. This method may involve providing your account details and following the instructions provided by the representative. This is typically useful in cases where online or mobile options are unavailable.

Required Information

To activate your ATM card, you’ll need specific details. These include the card number, personal identification number (PIN), and security code. Accurate and secure handling of this information is vital to prevent any security breaches.

- Card Number: This is a unique identifier for your ATM card, essential for linking it to your account. Always ensure you have the correct card number before proceeding with the activation process.

- PIN: A personal identification number (PIN) is a confidential code used to authenticate your identity and access your account. Choose a strong and memorable PIN to protect your funds.

- Security Code: Some banks may require a security code in addition to the card number and PIN for added security during the activation process. Always keep this information secure and confidential.

Activation Scenarios

Activation is necessary in several situations. These scenarios may include obtaining a new card, replacing a lost or stolen card, or a card replacement due to damage.

- New Card: Activation is required when receiving a new ATM card for the first time. This ensures that the card is linked to your account and ready for use.

- Lost or Stolen Card: If your ATM card is lost or stolen, activating a new replacement card is essential to prevent unauthorized access to your funds.

- Card Replacement: If your existing ATM card is damaged or unusable, you need to activate a replacement card to maintain access to your accounts.

Activation Process Table

This table Artikels the general steps involved in activating an ATM card, along with potential issues that may arise.

| Step | Action | Potential Issues |

|---|---|---|

| 1 | Obtain activation details, including card number, PIN, and security code. | Incorrect details provided. |

| 2 | Choose an activation method (online, mobile app, or phone call). | Selected method is unavailable or not supported. |

| 3 | Follow the instructions provided by the bank. | Technical issues with the chosen method. |

| 4 | Verify the activation status and confirmation. | Activation request rejected or delayed. |

Verification and Security

Activating your ATM card is a crucial step in ensuring its secure use. This phase focuses on establishing a robust security framework to prevent unauthorized access and fraudulent transactions. Beyond the initial steps, a layered approach to verification is paramount to protecting your financial well-being.Security measures during ATM card activation are designed to verify your identity and prevent misuse.

These measures often involve a combination of factors, including knowledge-based questions, one-time passwords, and in some cases, biometric authentication. This multi-layered approach aims to significantly reduce the risk of unauthorized access.

Security Questions

Security questions are a common method of verifying identity during activation. These questions typically ask for personal information, such as your mother’s maiden name, your childhood pet’s name, or the name of your first school. While these questions can be effective in preventing unauthorized access, their effectiveness depends on the complexity and uniqueness of the questions themselves. The strength of this security measure hinges on the user remembering and accurately answering these questions.

Activating your ATM card is a straightforward process, but sometimes it can feel like a whole ordeal. It’s like navigating a maze, especially when you’re trying to figure out if Big Nils is looking through your eyeballs, which can be quite unsettling. Big Nils looking through my eyeballs is a fascinating concept, but thankfully, activating your ATM card isn’t quite as unnerving.

Just follow the simple instructions and you’ll be back on track in no time.

One-Time Passwords (OTPs)

One-time passwords (OTPs) are crucial for adding an extra layer of security. These are unique, temporary codes sent to a designated device (often a mobile phone), providing an additional authentication step beyond the initial verification. OTPs are critical for ensuring that even if someone has access to your account details, they still lack the essential time-sensitive code to initiate transactions.

This approach greatly reduces the risk of unauthorized access.

Biometric Authentication

Biometric authentication utilizes unique physical characteristics to verify identity. Methods like fingerprint scanning, facial recognition, or voice recognition are increasingly used in online banking and ATM card activation. The unique advantage of this method lies in the inherent difficulty of replicating a person’s biological characteristics. This method enhances security significantly, especially in high-value transactions.

Security Protocols and Best Practices

Maintaining vigilance and following best practices during the activation process is essential. Be cautious about sharing your personal information with anyone who claims to be affiliated with your bank or ATM card provider. Do not respond to unsolicited calls or emails asking for sensitive information. Always ensure the website or application you’re using is legitimate and has a secure connection (indicated by “https”).

This vigilance significantly reduces the risk of falling victim to phishing or fraud attempts.

Comparison of Security Measures, Activate Your ATM Card

| Security Measure | Description | Effectiveness |

|---|---|---|

| Security Questions | Questions based on personal information. | Moderate |

| One-Time Passwords (OTPs) | Unique, temporary codes sent to a designated device. | High |

| Biometric Authentication | Verification using unique physical characteristics. | Very High |

Troubleshooting Activation Issues

Activating your new ATM card can sometimes be tricky. This section will guide you through common problems you might encounter during the activation process and provide solutions to get your card up and running smoothly. Understanding these issues and their resolutions will save you time and frustration.Many activation issues stem from simple errors, like typos or network glitches.

By following the steps Artikeld below, you can effectively address these problems and ensure a successful activation.

Common Activation Problems and Solutions

Incorrect information entry is a frequent cause of activation failures. Double-checking your details, such as your account number and PIN, before submitting them is crucial. If you suspect a typo, re-enter the information carefully, ensuring each character is accurate. If the issue persists, contact customer support for assistance.Network problems, such as slow internet speeds or temporary outages, can also hinder the activation process.

Ensure your internet connection is stable and try activating the card again. If the problem persists, try connecting to a different network or waiting a short period before trying again. In some cases, a restart of your device may also resolve network-related issues.

Troubleshooting Steps for Different Problems

A structured approach to troubleshooting is essential for efficient problem resolution. This section provides a step-by-step guide to resolve different types of activation problems.

- Incorrect PIN entry

– Re-enter the correct PIN. If the problem persists, contact customer support for assistance. Incorrect PIN entry is often the result of a simple mistake, but repeated attempts can lock the account. It is vital to avoid entering incorrect PINs repeatedly, as this could lead to account suspension. - Network error

– Check your internet connection. Ensure your device has a stable and reliable internet connection. Try activating the card again. If the issue persists, try connecting to a different network or waiting a short period before trying again. Network errors can be due to temporary outages or slow internet speeds, so a different network or a short wait might resolve the problem. - Technical difficulties

– Restart your device. If the issue persists, contact customer support. Technical difficulties during activation can arise from various sources, including software glitches, browser compatibility issues, or conflicts with other applications. A device restart can often resolve these issues. If the problem remains, customer support can provide tailored assistance to diagnose and rectify the technical difficulty.Need to activate your ATM card? It’s a pretty straightforward process, but sometimes it can be a pain. Speaking of things that can be a pain, have you heard about Neil Young and Crazy Horse’s latest album, “fn up”? neil young and crazy horse fn up is getting some serious buzz, and honestly, I’m kinda intrigued.

Regardless of the musical musings, activating your ATM card is important to keep your finances secure. Just follow the instructions and you’ll be good to go!

- Incorrect Account Information

-Double-check all account information. Double-checking ensures that all entered account details, including account number, are accurate and match the records on file. Incorrect information can lead to activation failures. Verify the information on your account statement for accuracy.

Contacting Customer Support

For assistance with any activation issues, you can contact our customer support team. They are available during specified hours and are equipped to address your concerns promptly. We are dedicated to ensuring your card activation process is as smooth as possible.Customer support contact information is available on our website. This contact information allows for quick resolution of any activation issues you may encounter.

Alternative Activation Methods: Activate Your ATM Card

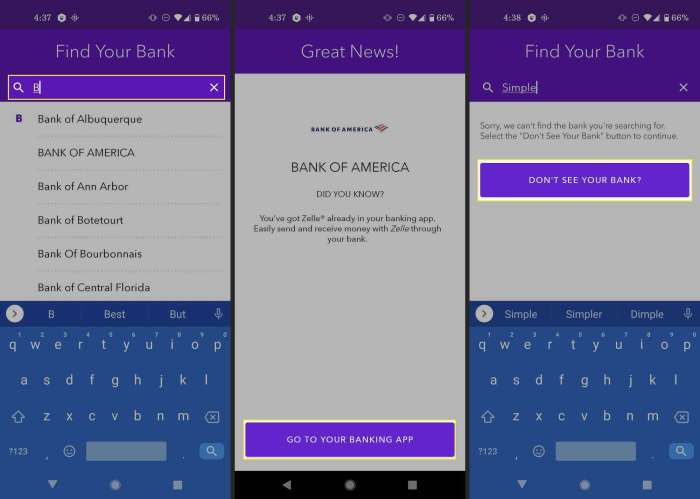

Activating your ATM card shouldn’t be a stressful experience. Fortunately, there are often multiple ways to get your card up and running. This section explores alternative activation methods beyond the standard online portal, offering more flexibility and convenience for cardholders.Beyond the initial online activation, banks often provide additional avenues for activating ATM cards. These alternative methods can be particularly useful for users facing internet connectivity issues or those who prefer a different approach.

Activating your ATM card is a straightforward process, but sometimes it can feel a bit tedious. While you’re waiting for that activation to go through, why not try crafting a beautiful wrist corsage? It’s a fun project to keep you occupied, and you can find a helpful tutorial on Make a Wrist Corsage. Once you’ve finished your floral masterpiece, you can get back to the important task of using your activated ATM card! Hopefully, the activation goes smoothly and you can enjoy your newly functional card.

Understanding the available options and their respective advantages and disadvantages is key to choosing the most suitable activation method.

SMS Activation

SMS activation utilizes text messages to confirm and complete the activation process. This method relies on the cardholder having a registered mobile phone number linked to their account. Banks send a unique code via SMS to the registered mobile number, which the cardholder then enters into the activation portal. This process typically requires the cardholder to follow the prompts provided in the text message.

A successful SMS activation can streamline the process, especially for users who prefer quick and convenient communication.

Email Activation

Email activation is another alternative for activating ATM cards. This method involves receiving an activation link or code via email. The link or code typically directs the cardholder to a secure website where they can complete the activation process. This method often provides more detailed instructions and potentially includes supplementary information about card security and usage. Email activation can be a reliable method, especially for users who prefer receiving instructions in a more structured format.

Comparison of Activation Methods

| Method | Pros | Cons |

|---|---|---|

| Online Portal | Convenient, accessible, often includes comprehensive instructions | Requires internet connection, potentially slower for users with unreliable internet |

| SMS Activation | Quick, convenient, utilizes readily available mobile phones, good for immediate access | Relies on a registered mobile number, may not be suitable for those without mobile service, could be vulnerable to SMS interception |

| Email Activation | Detailed instructions, potentially more secure than SMS, suitable for users with limited access to mobile phones | Requires an active email account, potentially slower than SMS activation, could be vulnerable to phishing attacks if not properly secured |

The table above summarizes the advantages and disadvantages of each method, highlighting the trade-offs between convenience, security, and accessibility. Choosing the best method depends on individual needs and preferences, considering factors like internet access, mobile phone availability, and personal security concerns.

Post-Activation Procedures

Congratulations on activating your ATM card! Now that the activation process is complete, it’s crucial to understand the next steps to ensure smooth and secure use of your new card. This section details the important post-activation procedures, from verifying your card details to maintaining accurate records.Successfully activating your ATM card is just the beginning. A proactive approach to managing your newly activated card is key to preventing issues and maintaining its security.

Following these post-activation steps will help you make the most of your card and keep your financial transactions secure.

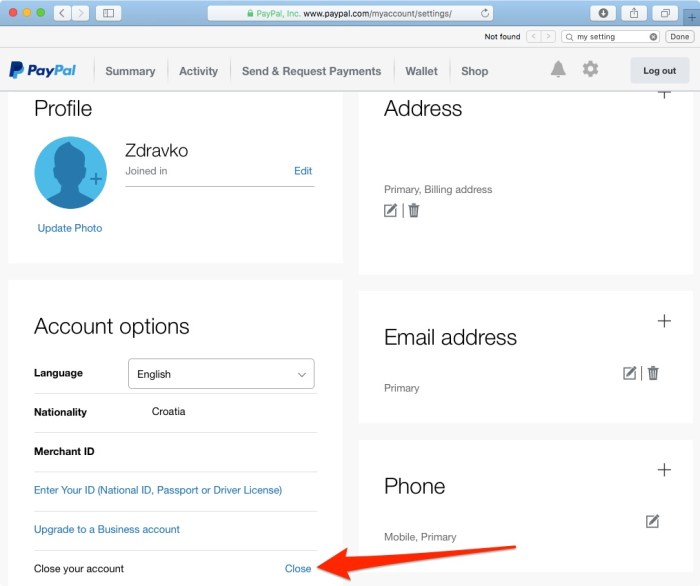

Verifying Card Details

Double-checking your card details ensures accuracy and helps prevent errors in future transactions. Mismatched information can lead to delays or rejection of transactions. Carefully review the card number, expiration date, and CVV code printed on your card to verify its accuracy against the activation confirmation. Discrepancies should be reported immediately to the issuing bank.

Storing Activation Confirmation

Maintaining a record of your activation confirmation is essential for resolving any potential issues. This confirmation document usually contains crucial information like your card number, expiration date, and activation date. Store this document in a safe and secure location, separate from your physical card, to prevent loss or damage. Consider using a secure online storage system, or a physical, locked file cabinet for added security.

Maintaining Records

Keeping detailed records of your activation process and subsequent transactions is a crucial aspect of responsible financial management. This record-keeping helps in case of disputes, fraudulent activities, or any unforeseen circumstances. Note down the date, time, location, and amount of every transaction made with your ATM card. This detailed record will serve as crucial evidence in case of disputes or inquiries.

Important Post-Activation Tasks

Understanding the importance of these tasks will ensure a smooth experience with your newly activated ATM card.

- Check card details for accuracy. Carefully compare the card details printed on the physical card with the information provided during activation and the activation confirmation. This ensures you are using the correct card information, minimizing the risk of errors in future transactions. Any discrepancies should be immediately reported to your bank.

- Store activation confirmation. Retain a copy of the activation confirmation document in a secure location. This document is vital for verifying your card details and resolving potential issues. Store it in a separate location from your physical card to prevent loss or damage. A password-protected online document storage or a locked file cabinet are examples of secure storage methods.

Ultimate Conclusion

In conclusion, activating your ATM card is a straightforward process, but understanding the steps and security measures involved is crucial. This guide provided a comprehensive overview of the entire activation journey, from initial steps to post-activation procedures. By following the advice and tips presented, you can confidently activate your ATM card and use it securely. Remember to keep your activation details safe and consult customer support if you encounter any issues.